Globalization and Financialization

The New Approach of Best Corporate Citizenship

Abstract

Globally speaking, the politics of globalization has been enormously debated. Current financial crisis has triggered the unenthusiastic brunt of people worldwide. This phenomenon is substantially caused by the impact of globalization. This paper will seek to understand the current financial crisis of financialization under the spectrum of globalization. The ongoing financial crisis of America and other regions of the world clearly translate the interconnectedness of the new approach of financialization conundrum. This paper elaborates the effect of globalization on financial flows and discovers the casualties from this crisis. The current United Nations Secretary General Ban Ki-moon called this crisis as “Slavery Perpetuated by Global Financial Crisis”.

First, there will be an introduction and some thought of pros and cons of globalization. Second, there will be an explanation of financial crisis, its casualties in our planet. Third, there will be suggestions and recommendations including the structure design to the new approach of best corporate citizenship to shoulder force in tackling this predicament.

Background

Globalization simply refers to the integration of regions into a global sphere. Many factors are considered the substantial proponents of globalization such as political ideology, social, culture, finance, technology, economics and geography that have drastically changed its shape to fulfill the lens of globalization. Many authors have linked current globalization to the belief of it is a repeating world history. Some said globalization has evolved around the expansion of human population and the invention of civilization such as the Sindhu of India, Roman Empire, or Han Dynasty of China. Some found that the historical routs of explorers and colonial agents are initially the links of flow of globalization such as the discovery of North America by Christopher Columbus or the Silk Road of Marco Polo. But the notion of globalization clearly emerged after the World War II when economists and politicians tried to restrain from continuing declining international economic integration and intractable division. The term itself was coined by different scholars interpreting in different periods. But in modern world, globalization has been preferably reiterated to identify the flows of trade, exchange of ideas and knowledge, technology, investment, and financial exchange. In Globalization and Its Discontent, Joseph Stiglitz defines globalization as “closer integration of the countries and peoples of the world which has been brought about by the enormous reduction of costs of transportation and communication, and the breaking down of artificial barriers to the flows of goods, services, capital knowledge, and (to a less extreme) people across borders” (Stiglitz, 2002). Part of this change is due to mobilization of labors and migration, but much of the larger part is due to changes in per capita income that is the “great divergence” as the ratio of per capita income of the richest to poorest nations are widened (Venables, 2006).

Primary concern of modern globalization is the economic driving the pace, scope and scale of this trend. It is dramatically accelerating the politic, culture and social to bend follow its force. Effort has been made to create “global government” to respond to current rapid change of social, political, economic. Motivation behind this effort is likely inspired by the achievement of the creation of the United Nations, the WTO, or the World Bank. Politics, culture and social have changed according to the scope and scale of economy. Some scholars argue that culture has embodied in the shape of more “divergent” than “convergent”, but some think oppositely. Remarkably, globalization creates both cultural homogenization and metropolitan multiculturalism. However, multicultural communication in management is essential for businessmen and students in this contemporary society.

In short, modern globalization drives politic, culture, economic and social in a type of corporation and investment. This phenomenon aggregates in the central flows of capital. Both human capital and financial capital orchestrate corporations to form, to function and to fasten. Otherwise, economists believe globalization may be the clarification of key trends in the global economy such as lower wages for worker, higher profit in the concept of Western world; the flooding of migrants from suburb areas to urban areas in the developing countries; and low inflation with low interest rates despite strong growth (BBC, 2007).

In the common sense of global village, globalization is driven by financialization, and the current ongoing financial crisis shall end the world or what? What measure should we recommend to tackle current crisis? The debate will motion around the finance, the corporations, and the people.

Globalization: The Pros and Cons

There are heated debate on the pros and cons of globalization. Some see that globalization has delivered technology innovation, knowledge, currency, jobs and growth to developing countries, but some have reversely argued that through this new trend the rich have continued to exploit the poor. Many giant corporations have earned their living at the expenses of the poor. Beside this, there are ecologically outsourcing as the natural resources have no place to hide from those aggressive high-tech capitalists. The worse consequences have consequently emerged such as the international terrorist network and the swift spread of SARS epidemics probably caused by globalization. These serious emergences have forced governments and scholars to adopt a more complex view (Weidenbaum, 2003). Weidenbaum also pinpointed the cheap labor has continually targeted by the sweatshop oversea corporations and the intractable degradation of environment.

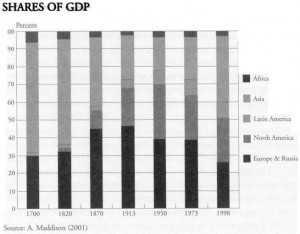

Globalization potentially produces equilibrium disparity including both income and productivity. Venables considered two types of nature geography impact on this disparity: international wage difference and economic conglomeration. Simply speaking, the income elasticity of the labors in developing countries easily take risk because the corporations can mobilize their factories or investments to other locations expecting of cheaper cost to maximize their benefit. For instance, in the era of globalization, the manufacturing move from N to S and the equilibrium wage gap narrows (Figure 1). An empirical study shows that real wages in a two country model has widely moved from N to S simply for the benefit of their corporations.

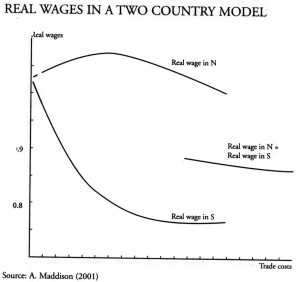

The evidence of income disparity is the measure of the impact of globalization in Gross Domestic Product (GDP). There are tremendous changes between 1700 and 1998 which Latin America appears in the wider scale as well as the Asia (Figure 2). The first question is: why are economic activity and growths spread so unevenly? Is it possible that an American really 50 or 100 times more productive than an Ethiopian? For instance, even within the UK, why are the earnings of a Londoner 70 percent higher than those of someone from Stoke-on-Trent (Venables, 2006).

The cause of inequality of globalization is the deficit of trade and investment which base on quotas and tariff. Especially the WTO, when its members open the border for free trade, the weak of production leads to huge trade deficit in developing countries. Also, many developed countries subsidized their farmers to produce crops causing the farmers of developing countries failed to gain their marginal benefit. In case of implementation of tariff in US, unregulated trade creates inefficiency when dead weight loss (DWL) is wider leading marginal social cost become worse (see figure 3).

Financialization: The Financial Crisis

Financialization simply refers to the flowing of finance capital, finance exchange, and finance interest rate. In Financialization of Daily Life, Randy Martin formulated the term financialization as following: “financialization is animated by the freeing of capital from its prior places of residence, and it is in the frenzied movement of currencies and other instruments of exchange that the mass of money available as investment outstrips the amount invested in industrial capacity” (Martin, 2002). The financial system is a mysterious machine and its shifts of regional loans transferring to global market identify financialization formless fluctuations of without having real money. Lehman Brothers Holding Inc. announced to file for liquidation on September 14, 2008 when its mortgage market and investor confidence crippled and was unable to find the buyer (NYtimes 2008). This bankruptcy is considered as the first spot caused current global financial crisis. Lehman has simply started collapsed as the mortgage market crisis unfolded in 2007. Consequently other companies and financial institutes fail to stabilize themselves. The phenomenon is uncontrollable when it was interconnected and unknown since the beginning.

This finance downturn has led to global awareness and political debates. Among world political leaders, Iran’s hard line president Mahmoud Ahmadinejad blamed America as the spearhead to this crisis and he declared that the crisis signaled the end of “the unjust and merciless” capitalist societies (Taiwan News, 2008). World Bank estimated that 40 million people will plunge into poverty in 2009 as the result of financial crisis. This financial crisis infiltrates to every country regardless of what their banking system is. At that Doha meeting, Secretary General of the United Nations Ban Ki-moon stressed it’s “the poorest countries that will feel the blow most sharply.”

Corporation and the Best Corporate Citizens

Globalization is constructing a world corporation and a global homogenous culture. It raises issues of global governance and challenges our future understanding of citizenship and civil society. In a world in which workers, from professionals to laborers, have to be constantly moving across borders, how far can membership of the nation-state still count as the basis of citizenship? And if global corporations are now overtaking national governments as the building blocks of world order, how should we adapt our concepts of civil society and citizenship? Can global companies be transformed into corporate citizens and defenders of civil society?

Instead of a world composed exclusively of nations, we now have various global organizations beyond the nation-state, such as the World Bank, the WTO and the IMF. And there’s a tension between these powerful political and economic forces on the one hand and non-government organizations and community movements on the other.

Princeton University’s Professor Richard Falk characterizes these forces as globalization from above and below. He said there are certainly plenty of claims that globalization has had broad economic benefits and economic growth, but alongside that you’ve got to look at who have been the winners and losers (Falk, 1999). There is clear evidence of growing inequality both across the world and in particular countries. You can see the losers in the factories and the villages of places like Africa, parts of Latin America. It’s not necessarily just a question of theoretical critique, it’s a very practical sense that there are winners and losers and the people whose lives have been perhaps worst impacted are saying enough is enough and there has to be another way.

In responding to this negative description of corporation in modern age of globalization, the investing in corporate social responsibility has been extensively requested by scholars and civil society. Ranging of different precepts in tackling inequality normally put in motion of sustainability, sustainable development, corporate responsibility, corporate social responsibility, corporate community investment, and corporate governance. All these regulations centralize in corporate governance that can equate corporations in both profitability and sharing with social marginal cost. Considering social goods, corporation has to focus on employee health, occupational and public safety, environment, business ethics, human rights, security and the company’s role in society (Hancock, 2004).

At least, we can divide corporation into three distinctive forms to articulate the effective solution to modern financial crises: the For Profit Corporation, the Non-Profit Corporation, and the Profit Enterprise or Hybrid Corporation of both profit and non-profit oriented corporation (Kelly, 2008). These three types of corporation share similar and distinctive governance systems.

For Profit Corporation (FPC) primarily prioritizes on profitability. The motivation of world corporations have the same target is to maximize the marginal benefit. Profitability is in fact the cornerstone of an effective corporate governance strategy and this is an essential feature of corporate responsibility (Llewellyn, 2004). FPC’s recipe for success bases on the identification adherence of ownership, profitable governance system, capitalization, high revenue and high compensation (see figure 4).

For Non-Profit Organization or Corporation (FNPC) genuinely base on the volunteering activities. This is the ideal model of modern civil society. But gradually it has transformed to other form deviating from non-profit orientation. Economically, the motivation is slack because of not having strong competition. However, this model has been inclusively embedded in human society long time ago beyond our imagination. The body systemized by operational governance, with both explicit and implicit compensation, and basically funded by foundation or private donation. (see figure 5)

For Profit Enterprise is a popular emerging requirement for our current financialization crunch. It is essential to hybridize this concept to balance both profitability and social goods contributability. The appearance of this third type of corporation is compared like the economic efficient theory of equilibrium that demand and supply, or marginal cost and marginal benefit must be in the curve of equilibrium. Formerly known as Non-Profit Organization can become For Profit Enterprise when their investment capital is not longer relied on donation anymore. On the other hand, the tendencies that For Profit Corporation will be optimistically become For Profit Enterprise. This For Profit Enterprise has been currently appealed by the corporate citizens to enhance themselves as the genuine entrepreneurs. For Profit Enterprise also bases on systematic governance that can uphold human beings motivation. This structure consists of ownership, governance, compensation and capitalization through meritorious benefit while its central goal is to achieve both social mission and profit. (see figure 6)

Conclusion

Globalization has brought both positive and negative impact to our earth. It is the double-edged sword phenomena. But the crucial mission for us is to maintain these two edges not to become too distant from each other. Finally, the phenomenon of financialization has brought us other alarming bell ring to consider this formless transaction as devastative. Current financial crisis can be solved if everyone is aware of minimizing personal interest by maximizing the social interest. The equilibrium of happiness is to trace in the middle path. Understanding three different types of corporation and try to modelize the For Profit Enterprise Corporation would be efficient for middle path implementation.

Significantly, there are three organizational archetypes of human species. For Profit Enterprise is the living system which can bridge the gap of the globalization of above (the transnational corporations) with the globalization of the below (the emigrational population). All living systems are “self-organizing” that has been populated by the values. Current capitalists’ values are “self-interest organizing” to struggle for personal growth and seek for cheap labors, output natural resources, and free market. But emerging new values are the awareness of “original interdependent organizing” of sustainability and well-being which are the core course of family growth and collective sustainable benefit. Through these basic comprehensive organizing, we can see the nation-states, civil societies, and corporations have paid attention to create ethic codes, regulations and universal norms to achieve genuine social enterprise.

Future research would empirically concentrate on the effectiveness and deviation of above three types of corporation.

References

Anthony J. Venables. (2006). “Shifts in Economic Geography and Their Cause,” The Journal of Economic Review, Volume 91: 61-85

Stiglitz, Joseph E. (2002). “Globalization and Its Discontent,” W. W. Norton & Company

Randy, Martin. (2002). “Financialization of Daily Life,” Temple University Press, Philadelphia

Richard, Falk. (1999). “Predatory Globalization: A Critique,” Polity Publisher

John, Hancock et al (2004). “Investing in Corporate Social Responsibility,” Kogan Page Publishing, London & Sterling, VA

Thomas M. Hoenig. (2008). “Maintaining Stability in a Changing Financial Crises: Some Lessons Relearned Again?”. Economic Review, First Quarter

Stephen Redding & Anthony J. Venables. (2001). “Economic Geography and International Inequality,” International Trade

Yeats, Alexander J. (1998). “Just how big is global production sharing?,” Policy Research Working Paper Series 1871, The World Bank.

Francesco Caselli & Nicola Gennaioli. (2007). “Economics and Politics of Alternative Institutional Reforms,” CEP Discussion Papers, Centre for Economic Performance

Marjorie, Kelly. (2008). “Best Corporate Citizenship: Integrating Social, Environmental and Financial Concerns”. Paper Presentation on Wednesday, November 19, 2008 at the University of Hawaii

_____________(2001). “The Devine Right of Capital: Dethroning the Corporate Aristocracy,” Berrett-Koehler Publishing, Inc. San Francisco

BBC (2006). “Globalization shakes the world: http://news.bbc.co.uk/2/hi/business/6279679.stm”. Accessed on November 29, 2008

Murray Weidenbaum. (2003). “Weighing the Pros and Cons of Globalization: http://www.wilsoncenter.org/topics/pubs/Weidenbaum.pdf”. Accessed on November 29, 2008

NYtimes.com (2008). “Lehman Brothers Holdings Inc.: http://topics.nytimes.com/top/news/business/companies/lehman_brothers_holdings_inc/index.html?inline=nyt-org”. Accessed on November 29, 2008

Taiwan News. (2008). “Ahmadinejad: West to blame for financial crisis: http://www.etaiwannews.com/etn/news_content.php?id=800023&lang=eng_news ”. Accessed on November 29, 2008

Figures Illustration

Figure 1

Figure 2

Figure 3

Source: group study of Plan 603 Fall 2008 on “Globalization: good or bad for urban development?”

Figure 4

Figure 5

Figure 6